Welcome to

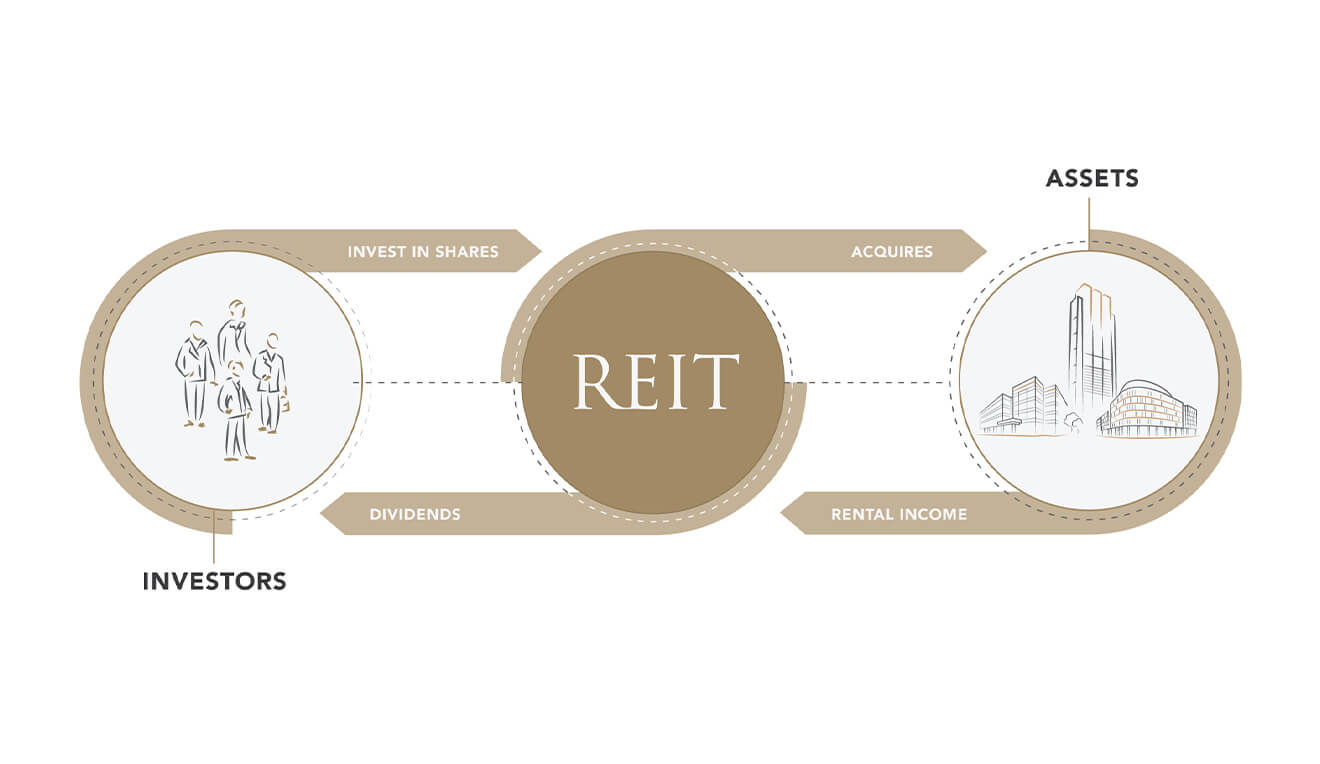

Emirates REIT is one of the UAE's largest listed Sharia-compliant Real Estate Investment Trusts (REIT). It was the first REIT incorporated in the UAE in 2010 and has approximately USD 1.1 billion in assets under management. Emirates REIT is incorporated in the DIFC and licensed by the DFSA.

Why Invest in Emirates REIT?

Emirates REIT's portfolio is composed mostly of commercial and education assets. This blend of high-end properties was composed to provide the REIT's shareholders with a safe, stable, and steady income.

Number of Properties

8

Net Leasable Area

168,222 sq.m

Portfolio Value

USD 1,042.7 million

About the fund

Founded in 2010, Emirates REIT became the first Real Estate Investment Trust (REIT) in the Middle East. With seed investors such as Dubai Islamic Bank, Tecom, and Dubai Properties, Emirates REIT was the first REIT to be listed in the Gulf on 8th April 2014 on Nasdaq Dubai in DIFC. Emirates REIT has successfully raised USD 400 million through a Sukuk in December 2017.